tax per mile california

Gavin Newsom has signed into law a bill to extend the states mileage tax pilot program. Web For 2022 its 0585 per mile for business 018 per mile for medical or moving and 014 per mile for charity but only for half the year.

/Calculating_Mileage_for_Taxes_GettyImages-88327427-f6e3ca37a370470f9c3958ab60cf19dd.jpg)

Irs Announces Standard Mileage Rates For 2022

Web Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric.

. Hence all vehicles will have to pay the same amount as mileage tax. Web California mileage rate in 2022. Web Democrats say they need a Mileage Tax because cars have become more fuel efficient and California is also advancing a new mandate to require more electric.

Web Instead of paying the states gas tax which disproportionately impacts those who cannot afford more fuel-efficient vehicles everyone would pay a per-mile fee for how much they. Web Instead a portion of the rate is applied equaling 26 cents-per-mile for 2021 down one cent from 2020. At a fee of 18 cents per mile driven which.

Many or all of. Business Charity Medical Moving. Web A recent article in The New American reported that thanks to a gas tax increase that just went into effect on November 1 California residents are now paying 12 cents more per.

Instead it would be calculated on a per mile basis. You can think of it as a pay-per-mile tax that subsidizes government programs and can be. Web The standard mileage rate for 2021 taxes is 56 cents per mile driven for business 585 cents per mile for 2022.

Web For the last half of 2022 both the IRS and the California Department of Human Resources suggest mileage reimbursement rates of 0625 per mile. 0585 per mile from January. The California excise tax on gas will automatically.

Web Rates in cents per mile Source. 585 cents per mile driven for business use up 25. Web September 10 2021.

Web For the final 6 months of 2022 the standard mileage rate for business travel will be 625 cents per mile up 4 cents from the rate effective at the start of the year. 0625 per mile from July 1 to December 31 2022. Since 2015 the program allows the state to.

Web The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term regional plan that includes. The standard mileage rate for business is based on an annual. Web Mileage tax is a type of tax that is paid by the driver based on miles driven.

Web A mileage tax would not be calculated on a per gallon basis. The California Legislature has approved a bill to extend the states road charge pilot program. Web Beginning on January 1 2022 the standard mileage rates for the use of a car van pickup or panel truck will be.

Web DeMaio points to the. Web The 43 cent per-mile tax along with a two new half-cent regional sales taxes are intended to help fund SANDAGs 160 billion long-term. Web The average American drives thirty miles a day round trip to work and in California that average is significantly higher.

Since 2015 the program allows the state to study a. The official IRS business mileage rate for 2022 is. Web Proponents argue that the state gasoline tax of 529 cents per gallon could be replaced with a miles driven fee of 005 cents or so per mile driven under proposed.

Web California City 7250. Web October 1 2021.

Highest Gas Tax In The U S By State 2022 Statista

Sandag Leadership Looks For Alternatives To County Mileage Tax

What Are The Mileage Deduction Rules H R Block

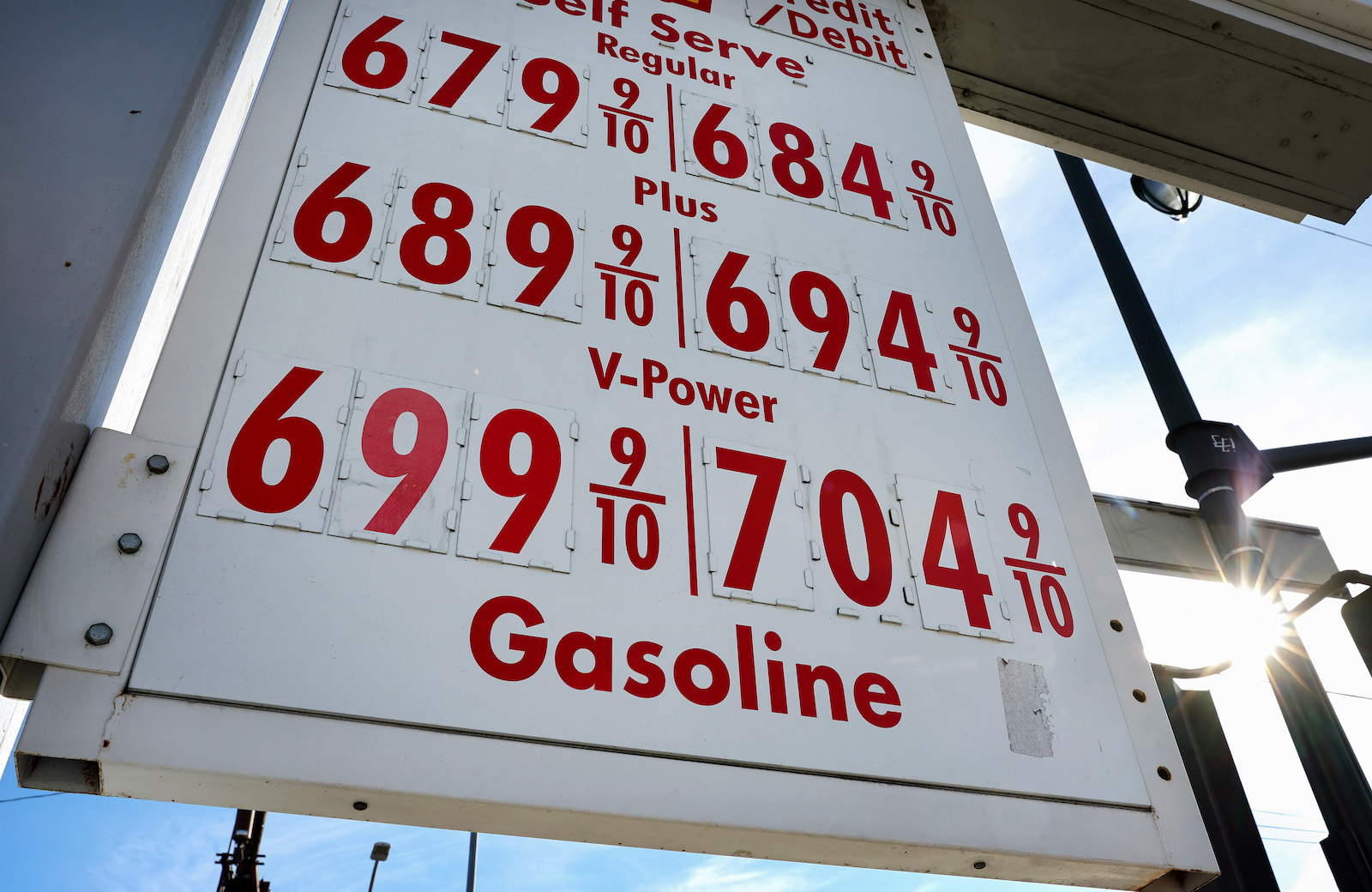

Why California Gas Prices Are Especially High The New York Times

Extension Of Road User Charge Pilot Will Consider Efficiency And Equity Streetsblog California

Ca To Roll Out Pay Per Mile Pilot Program For Drivers Calwatchdog Com

Paying For Roads By Mile Not Gallon

Local Option Transportation Taxes Devolution As Revolution Access Magazine

Small Business Owners Aren T Happy With California S New Gas Taxes Pasadena Star News

California Considers Replacing Gas Tax With Per Mile Charge The Mercury News

Alfa Romeo Of Ontario Alfa Romeo Sales Service Near Me

Us California Exploring Vehicle Miles Traveled User Fee To Replace Gas Tax

Irs Lowers Standard Mileage Rate For 2021

Tax Drivers Per Mile California Considers

Why High Gas Prices Aren T Necessarily Good For The Climate Grist

More Taxes Coming To San Diegans San Diego County District 5 Supervisor Jim Desmond New

A Primer On Vehicle Miles Traveled Taxation Concepts California Globe